Georgia payroll tax calculator

Calculate your Georgia net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Georgia. All you have to do is enter wage.

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Ad Compare This Years Top 5 Free Payroll Software.

. Higher earners pay higher rates although Georgias brackets top. Work out your adjusted gross income. You are able to use our Georgia State Tax Calculator to calculate your total tax costs in the tax year 202223.

The Salary Calculator is an excellent tool for identifying how your payroll deductions and income taxes are split up with details of how each is calculated and the percentage of your salary that. Annual gross is between 8000 and 10000. Employers can find their estimated state withholding rate using Form G-4 Georgia.

Luckily our Georgia payroll calculator eliminates all the extra clutter associated with calculating payroll so your administrative duties wont be quite as dull. Ad Compare This Years Top 5 Free Payroll Software. Annual gross is less than 8000.

Free Unbiased Reviews Top Picks. This includes tax withheld from. Just enter the wages tax withholdings and other information required.

Customized for Small Biz Calculate Tax Print check W2 W3 940 941. This guide is used to explain the guidelines for Withholding Taxes. Payroll processing doesnt have to be taxing.

Withholding tax is the amount held from an employees wages and paid directly to the state by the employer. All Services Backed by Tax Guarantee. 2022 Employers Tax Guidepdf 155 MB 2021 Employers Tax Guidepdf 178 MB.

Paycheck Results is your gross pay and specific. With just a few clicks the Gusto Georgia Hourly Paycheck Calculator shows you how payroll taxes are calculated. Calculate Your Georgia Net Pay Out Or Take Home Pay By Coming Into Your Per.

Our calculator has recently been updated to include both the latest Federal Tax. Use ADPs Georgia Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. The results are broken up into three sections.

Supplemental Wage Bonus Rates. Content updated daily for ga payroll calculator. Figure out your filing status.

Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More. This Georgia hourly paycheck. On the other hand if you make more than 200000 annually you will pay.

The first thing you need to know about the Georgia paycheck calculator is your hourly and salary income as well as the various pay frequencies. Ad Payroll So Easy You Can Set It Up Run It Yourself. Luckily our Georgia payroll calculator eliminates all the extra clutter associated with calculating payroll so your administrative duties wont be quite as dull.

Annual gross is between 10001 and 12000. To correctly calculate the state income tax withheld employers must have Form G-4 for each employee. Georgia Salary Paycheck Calculator Results.

Select your current state from the checklist below to find out the hourly paycheck loan calculator. If you want to determine your. Calculating your Georgia state income tax is similar to the steps we listed on our Federal paycheck calculator.

Below are your Georgia salary paycheck results. Georgia utilizes a relatively simple progressive income tax system with rates ranging from 100 to 575. Free Unbiased Reviews Top Picks.

As of 2022 the Medicare tax is 145 of your wage and the social security tax is 62 of your salary. The state income tax rate in Georgia is progressive and ranges from 1 to 575 while federal income tax rates range from 10 to 37 depending on your income. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set.

Ad This is the newest place to search delivering top results from across the web. All you have to do. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

![]()

Georgia Paycheck Calculator 2022 With Income Tax Brackets Investomatica

Paycheck Deductions

1

Paycheck Calculator Take Home Pay Calculator

Payroll Tax Calculator For Employers Gusto

![]()

Free Georgia Payroll Calculator 2022 Ga Tax Rates Onpay

1

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

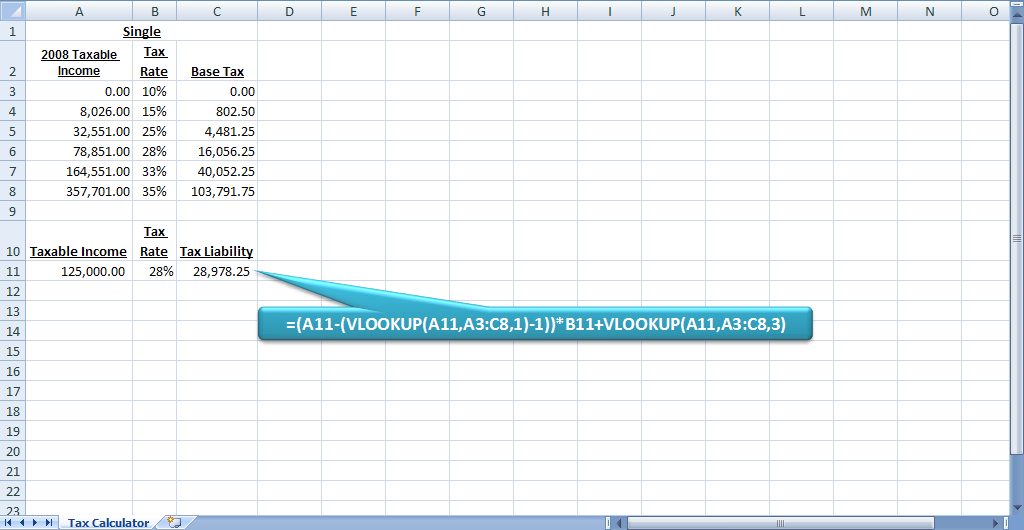

Build A Dynamic Income Tax Calculator Part 1 Of 2 Accounting Advisors Inc

Georgia Paycheck Calculator Smartasset

5zba3sq8pakyvm

80 000 Income Tax Calculator New York Salary After Taxes Income Tax Payroll Taxes Salary

Georgia Sales Reverse Sales Tax Calculator Dremploye

Llc Tax Calculator Definitive Small Business Tax Estimator

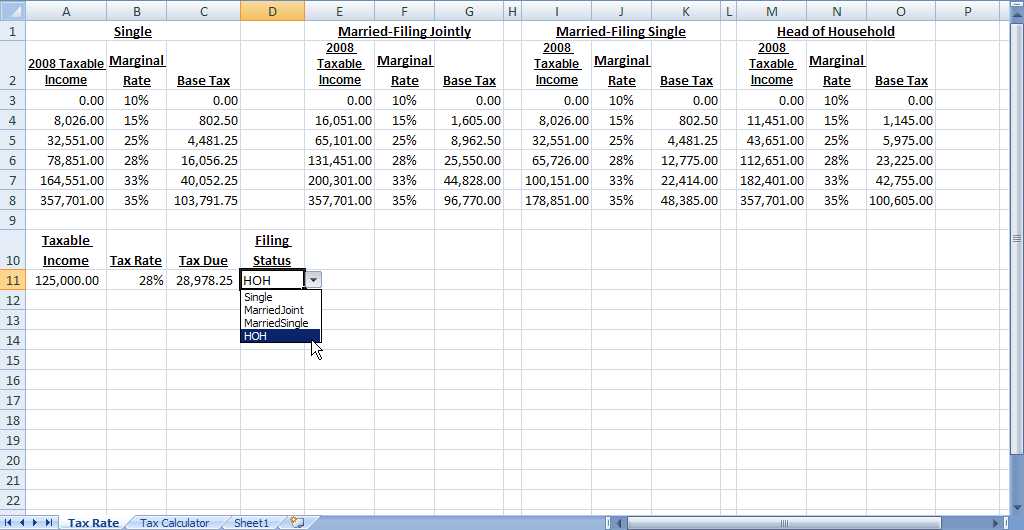

Build A Dynamic Income Tax Calculator Part 2 Of 2 Davidringstrom Com

3

Paycheck Calculator Take Home Pay Calculator